These days it is easy to borrow money online because there are numerous mobile app offering this service. Opay is one of those mobile app that offer amongst other things loan to its customer. If you need loan for your business or you need it to solve personal problems, you can borrow from Opay.

Many people choose to borrow money from Opay because it is one of the best loan app in Nigeria. If you are wondering how to borrow money from Opay? you don’t have to wonder anymore as we will be revealing the easy way to do that in this article. Before we dive into the main topic let us give you a brief information about Opay.

About Opay

OPay Digital Services Limited is a one-stop mobile-based platform for payments, transfers, loans, savings and other essential services for every individual. It was founded by Opera Norway AS Group in 2018 and has its operations in countries like Mexico, Nigeria, Egypt and Pakistan.

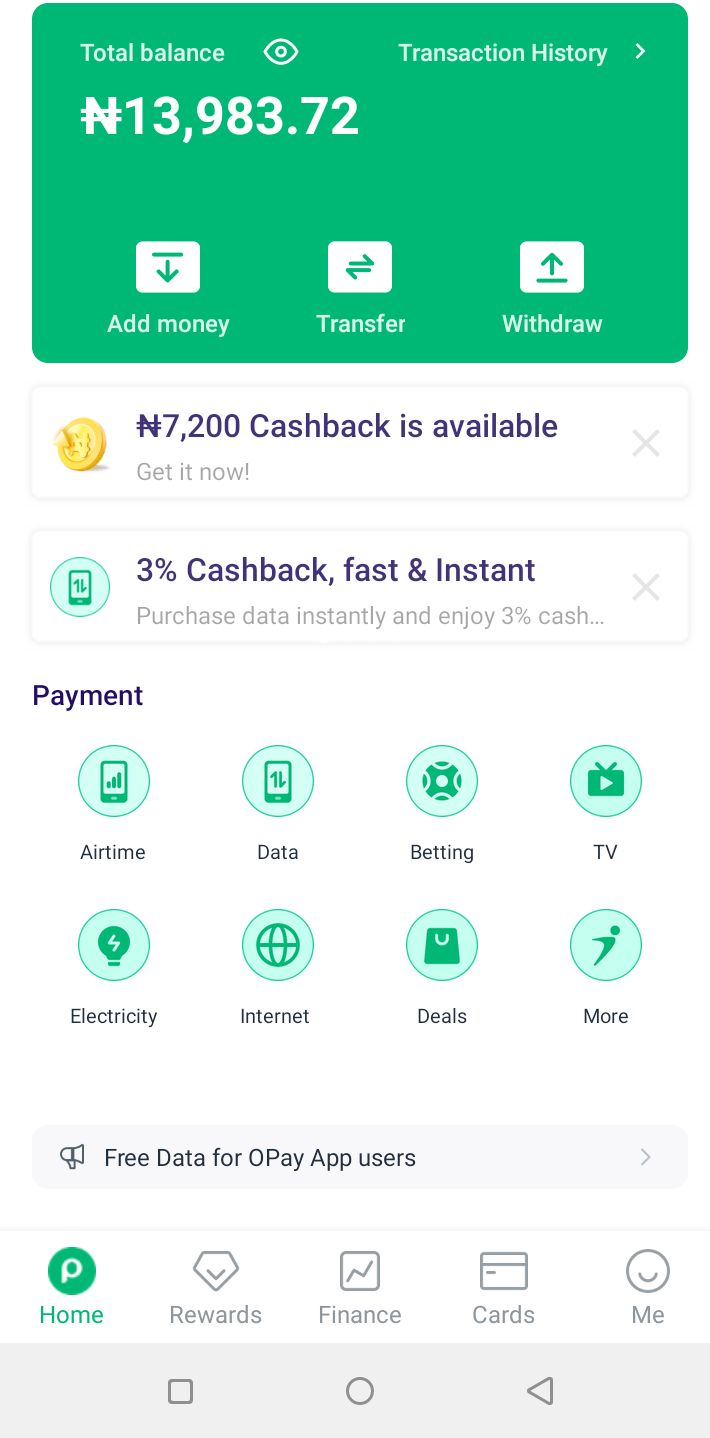

This company also has an emerging market across Asia. Opay is a very popular app in Nigeria as over 18 million people make use of the app. Individuals can use the app to carry out different transactions like buying airtime, buying data, subscribing to Pay TV, paying electric bills and more.

Opay also has service like OCar and OTrike for hailing a ride. Persons can get food delivered to them with the use of OFood. For borrowing of money you can make use of OKash. Opay also give users the opportunity to invest with OWealth. The app can also be used to send and receive payment, fund your betting account, list your products and services with OList and build an online presence with OLeads.

This digital service company also gives business the opportunity to carry out transaction seamlessly through their POS machines. Opay has one of the best POS machine in Nigeria. The machine is very fast, cheap to purchase and easy to use. Opay has about 500,000 agents in Nigeria who rely on their platform to do their business.

How To Borrow Money From Opay

There are several step you will have to follow in order to apply for loan on Opay. They are explained below:

1. Download the Opay App

In order to borrow money from Opay, you first have to download the Opay app on your smartphone. The app is available for both Android and iOS devices and can be downloaded for free from the respective app stores.

After you have downloaded the app, you will need to create an account by providing some basic information such as your name, email address, and phone number. If you are using a computer system, you can also sign up for Opay by creating a user account through their website.

2. Apply for a Loan

Once you have downloaded the app and opened an account you can now apply for Opay loan. To apply for a loan from Opay, you will need to follow these steps:

- Open the Opay app and log in to your account.

- Click on the “Loan” icon on the home screen.

- Choose the loan amount you need and select the repayment period.

- Fill out the loan application form with your personal information, employment details, Bank verification number and bank account information.

- Submit your application.

3. Wait for Approval

After you have submitted your loan application, you will need to wait for approval from Opay. Opay will review your application and make a decision based on your creditworthiness, which includes your credit score, income, and other factors. If your application is approved, you will receive a loan offer from Opay.

4. Accept the Loan Offer

If you are happy with the loan offer from Opay, you will need to accept it. The loan offer will include details such as the loan amount, interest rate, repayment period, and any fees associated with the loan. Make sure to read the terms and conditions carefully before accepting the offer.

5. Receive the Loan

After every other step is complete you will receive your loan with minutes. The funds will be deposited into your Opay account. You can then transfer the funds to your bank account or use them directly from your Opay account to carry out transactions.

Requirements To Borrow Money From Opay

In order to be eligible to borrow money from Opay, you need to meet certain requirements. They are listed below:

- You must be 20 years and above

- You must be resident in Nigeria

- The borrower must have a valid means of identification (National ID card, Voters Card, Drivers license, International Passport)

- You must have a registered Opay account. In this case Okash which is the application you will use to apply for the money

- Must have a valid Bank Account

- You must have Bank Verification Number (BVN)

- You must have a working email and phone number.

How Much Can You Borrow From Opay

If you are applying for Opay loan for the first time, the maximum amount you can borrow at a time is N50,000. Subsequently you can get a higher amount once it has been confirmed that your previous loan has been paid on time.

There is no limitation when it comes to the minimum amount you can borrow from Opay. Opay users can get as low as N3,000 from the app.

What Is The Interest Rate On Opay Loan and Repayment Period

Opay interest vary and depend on amount borrowed and length of loan. They charges a daily interest that range from 0.1% to 1% on loan collected. Users of the loan app can pay an annual interest that range from 36.5% and 360%. For a fix term of 15days loan they charge a daily interest of 1.2%

Also users will have to pay an origination fee with the loan ranging from N1299 to N6000. Opay loan can be repaid within 91 days, which is the shortest tenure and 365 days which is the longest tenure.

Opay Loan USSD Code

Asides from the Opay app, you can also borrow money from Opay using USSD code. All you need to do is dial *955# on your mobile phone and follow the instructions that follows to get your loan. This option only works for people who already have a registered account on the Opay platform.

Tips for Borrowing Money from Opay

Before you borrow money from Opay here are a few tips to guide you.

1. Check your Credit Score: Because Opay rely a lot on credit score to determine your eligibility for a loan, it is important to have a good credit score. Your credit score plays a significant role in determining whether or not you will be approved for a loan from Opay. Before applying for a loan, it’s a good idea to check your credit score and make sure it’s in good standing.

2. Borrow only what you need: While it may be tempting to borrow more money than you need, it’s important to remember that you will need to pay interest on the entire loan amount. Only borrow what you need and can comfortably afford to repay.

3. Pay on time: It is important that you keep to the time frame given by Opay to repay your loan. Making timely payments is crucial when it comes to borrowing money from Opay. Late payments can result in additional fees and may negatively impact your credit score.

4. Compare loan options: Before applying for a loan from Opay, it’s a good idea to compare their loan options with other lenders. This can help you find the best loan terms and interest rates.

How To Repay Opay Loan

In order to pay back Opay loan borrowed you will have to follow this simple instruction:

- Open your mobile app

- Log into your account

- Click on the button that says ‘make a repayment’

- Provide all required details

- Click on the ‘repay’ button

Because your bank information is linked to your Opay account, once your payment is due Opay will automatically debit your account. Therefore you will not be required to follow the instruction above to repay your loan. But in the case this doesn’t happen, then you can use this process above to repay.

How To Contact Opay

If you require further information or services, you can contact Opay on their website, email, phone number or pay a visit to any of their offices.

See here for the list of Opay offices in Nigeria. You can also find their phone number and email address on this list.

It is easy to borrow money from Opay to solve any impending issues. It is also important to remember to borrow what you can pay back and also pay on time.