In a bid to curb the financial constrain lots of Nigerians face, the Nigerian government has given license to micro-lending spaces like online loan apps to provide its citizens with loan. These loan apps have made the availability of money easier for Nigerians.

Providing citizens with as much as N4,000,000 loan with the barest minimum interest rate. This loan apps after getting license from the Federal Competition and Consumer Protection Commission(FCCPC), operates as digital lenders.

People that require loans from these lenders just need to download their app and fill out a form which would be provided to them. There are hardly collateral required to get money from these apps and the time frame for refund is quite flexible. This loan apps are good for ordinary citizens who find the banking procedure for loan request regorous.

While these loan apps exist to reduce the burden of the common man, there are some that are not authorized or just offer service that are not commendable. This is why it is important to know the best loan apps in Nigeria and their repayment terms.

In this article we will be highlighting the best loan apps in Nigeria. These loan apps offer varying interest rates, loan limits, and repayment terms. Users mostly need their smartphones and mobile technology to access this loan app. Below is the list of the best loan apps in Nigeria.

Top 10 Best Loan Apps In Nigeria

1. FairMoney

FairMoney is one of the best loan apps in Nigeria. This loan app offers up to N500,000 loan to its customers with repayment terms of up to 9 months. The app has over 10million downloads on app store making it one of the most downloaded loan app in Nigeria.

The app is regarded as an instant loan app as funds are disbursed within minutes of approval. Some people call it a 5 minutes loan app. All the applicant has to do is fill out the application form which is simple and straightforward, and they will receive their money instantly.

Customers can request for loans without collateral and get up to ₦1,000,000, while small business Enterprise who require loan can get up to N5,000,000. Credit history is what is used to determine eligibility of loan.

The interest rate of this loan app ranges from 10% to 30% depending on several factors. It is one of the simplest and best loan app in Nigeria.

2. PalmCredit

PalmCredit is another loan app that is considered very efficient by Nigerians. It is owned by Transsnet financial Nigeria Ltd. This loan app offers loan of up to N100,000 with repayment terms of up to 6 months.

It is a collateral-free loans app which is capped at ₦100,000 with interest rates ranging from 14% to 24%. The app also provides a credit score to help borrowers improve their creditworthiness. People who use this loan app are given the condition of repaying the loan between 14 days to 180 days after disbursal.

This loan app is loved by Nigerians and has over 5 million app downloads on app store.

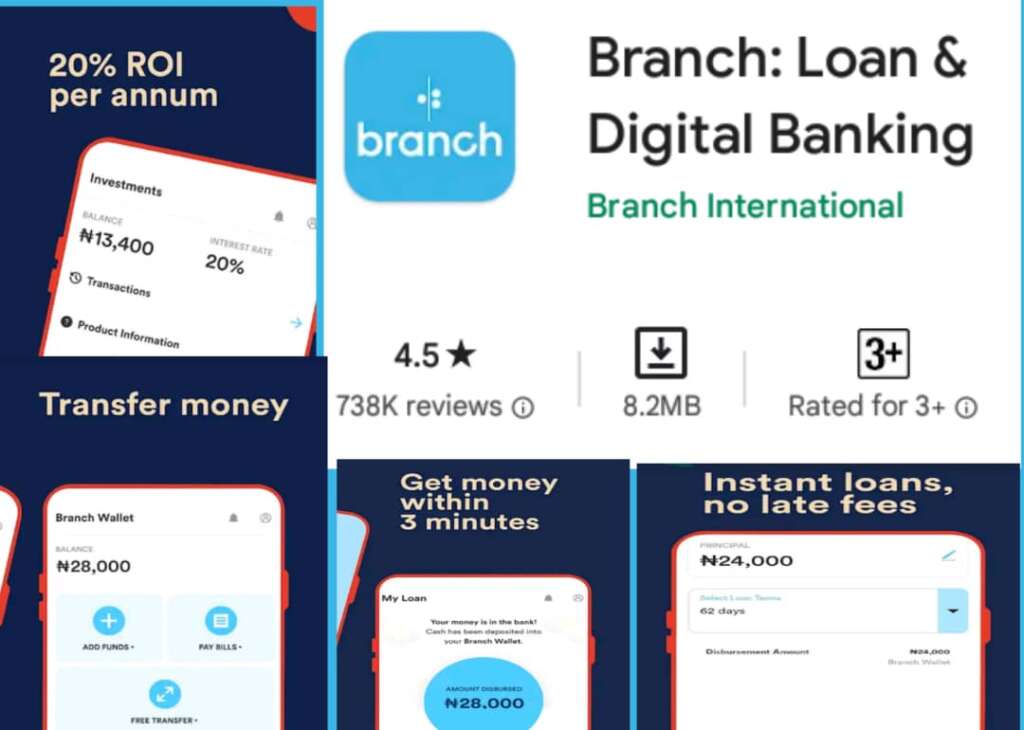

3. Branch

Branch is one of the most used loan app in Nigeria. It has over 10 million downloads and give quick online loans with a repayment period of 61-180 days. Users can borrow up to N200,000 with repayment terms of up to 15 months.

The interest rate ranges from 15% to 34%. Users of the app enjoy easy application procedure and are not required to submit any document. The app also provides a credit score to help borrowers improve their creditworthiness.

It is one of top loan app in Nigeria with quick payment.

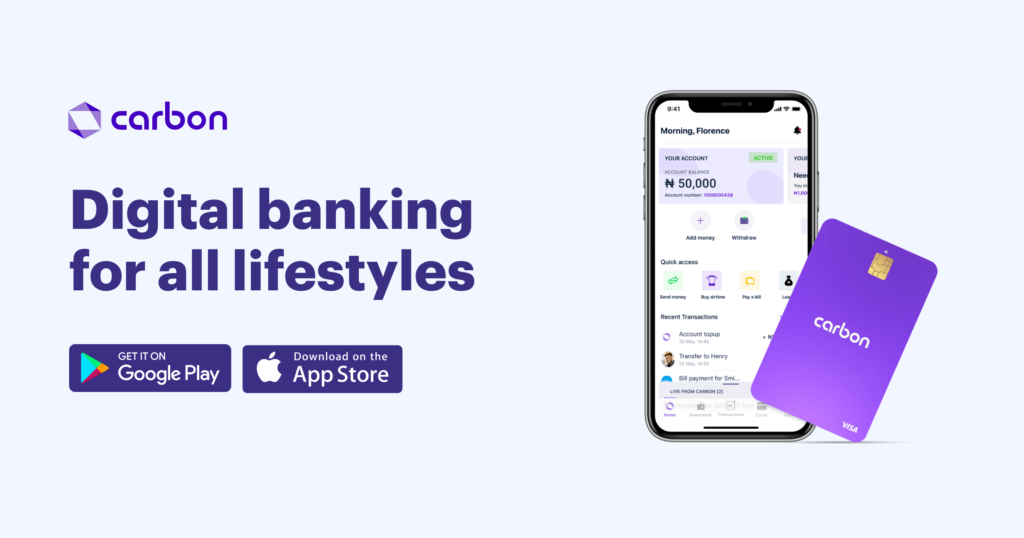

4. Carbon (formerly Paylater)

Carbon is one loan app that provides loans of up to N500,000 with interest rates as low as 5%. It has an easy and seamless loan application process and funds are usually disbursed within minutes of approval.

It is also a popular loan app for online purchase as users can buy needed commodities to pay back in instalments at a later date. The app usually give a time frame of 3 – 6 months for repayment as long as customers make an initial deposit of 25% of the product price.

The app has over 1 million downloads on app stores. It is one of the most popular loan app.

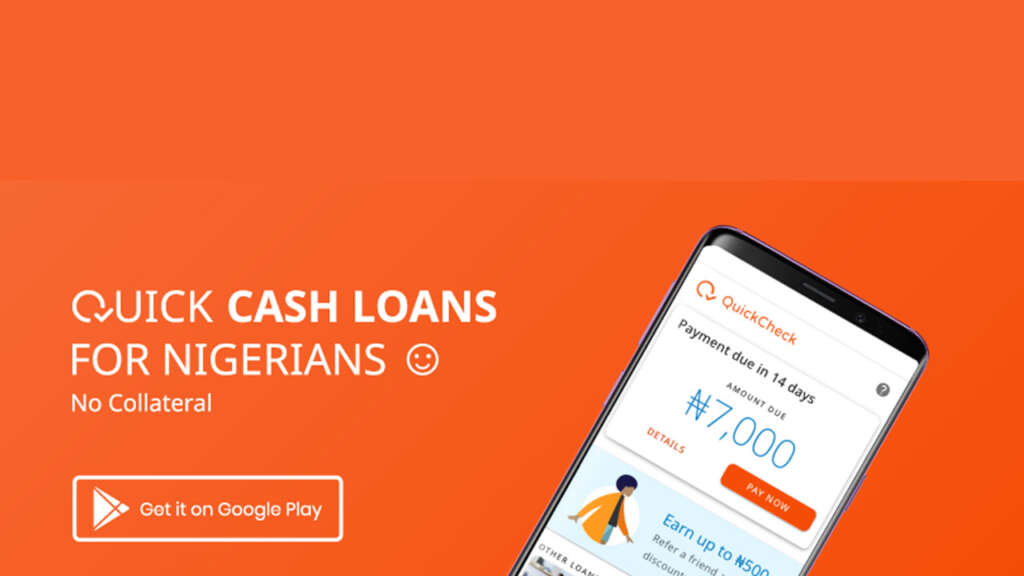

5. QuickCheck

Just like their name QuickCheck offers instant loan of up to N500,000 with repayment terms of up to 12 months. Customers can download their app on app store, fill up the application form and get instantly credited.

They have an interest rate that ranges from 1% to 15%. The app works with credit score and has been downloaded by over 1million users on app stores.

6. Aella Credit

Aella Credit is one of the best loan app in Nigeria. It offers instant loan to small businesses and individuals. All you need to do is download the app and fill in the required information in the application portal.

Users of the app can get loans of up to N1,000,000 with repayment terms of up to 2 months. The interest rate ranges from 4% to 29%. This app makes use of credit score. The credit score is used to decide creditworthiness and the more you repay the loan, the higher your credit score.

7. Specta

Specta assures customers the ability to request for loan and be credited in 5 minutes. Users can get up to N5,000,000 with repayment terms of up to 12 months. The interest rate ranges from 3% to 26%.

Specta is a product of Sterling Bank Plc. Asides from loans it can also be used to shop online and pay later. With the PayWithSpecta customers can get digital credit to help them shop from any store and spread payment.

8. RenMoney

RenMoney has gained popularity over the years as one of the top loan app in Nigeria. It has over 500,000 downloads on app store and is rated high by customers. This loan app offers loans of up to N4,000,000 with repayment terms of up to 24 months.

Customers are offered interest rate which ranges from 4% to 4.5%. The loan application process is quick and easy, and users are required to submit a bank statement, government ID and utility bill as part of the application process.

Once all requirements are fulfilled, users can get their loan credited in their account within 24 hours of approval.

9. Lidya

Libya offers loan to small business enterprise as well as individuals. Users can get loans of up to N15,000,000 with repayment terms of up to 12 months.

Lidya was founded in Nigeria in 2016 by Co-Founder & CEO Tunde Kehinde and is

headquartered in the US. The loan company gives an interest rate that ranges from 1% to 4.5%. It has a simple and straightforward application process. Customers get funds credited to their account within hours of approval.

10. KiaKia

KiaKia was founded in 2016 as a licensed non-banking financial technology company. It offers secured and unsecured loans and also participates in well-structured profit-sharing business transactions. Their main interest is in Micro, Small and Medium Enterprises with huge growth potentials, with no access to credit from traditional financial institutions.

Customers who use KiaKia can get up to N500,000 loan with repayment terms of up to 30 days. They have an interest rate that ranges from 5.6% to 24%. This loan app has a quick and easy application procedure and users can get their funds credited to their account once loan is approved.

As the Nigerian economy continues to evolve, the need for quick and accessible loan options becomes more necessary. These loan apps have revolutionized the lending industry in Nigeria by providing quick and accessible loans to Nigerians. They are the best loan apps in the country.